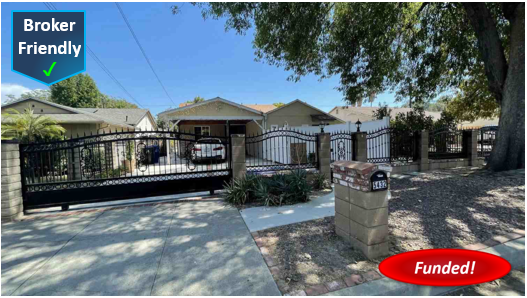

Closed! Hard Money Construction Loan in Apple Valley: $584,000 @ 11.75%, 1st TD, Cash-Out, SFR, 80.00% LTV

3x Successful Mortgage Vintage borrowers and 30+ years experienced residential developers sought a 1st TD loan to finish development on this “pre-sold”, SFR property in Apple Valley, San Bernardino County, CA. Borrowers own “Evergreen Homes, LLC” Evergreen Homes (evergreenhomesca.com). Borrowers have already built and sold 55+ SFRs similar to this subject property in this same…