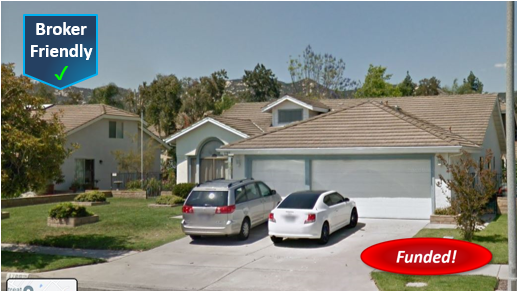

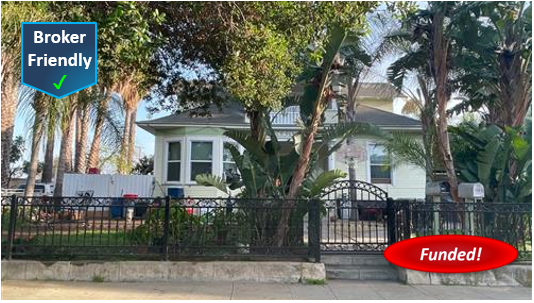

Recently Funded Blanket Loan in Escondido: $805,000 1st TD, 55.52% LTV, Purchase, 9.25% Lender Rate

Borrower sought a 1st TD blanket Loan on the subject SFR properties which are being used by a Non-Profit to house court placed abused minors. The borrower is on the Board of the Non-Profit, “Circle of Friends” and together they have the opportunity to purchase these two SFR’s that they have been operating in for…