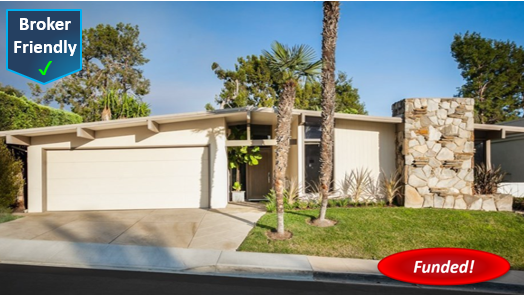

Recently Funded Hard Money Loan in Corona Del Mar: $170,000 @ 11.00%, 2nd TD, Cash-Out, Single Family Residence, 65.90% CLTV

Borrowers sought a $170,000 business purpose 2nd Trust Deed loan on this non-owner-occupied single-family residence in Corona Del Mar, Orange County, CA. The loan proceeds will be used to make some upgrades to the property. The borrower’s 1st mortgage is with 5th Street Capital and has a principal balance of $2,466,199 with a fixed interest…