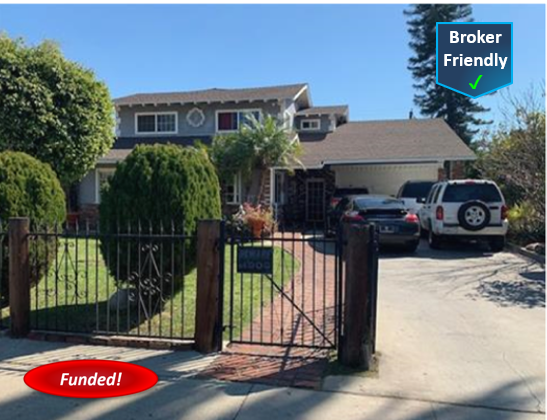

Recently Funded Hard Money Loan – Bell Gardens: $60,000 2nd TD, 63.29% CLTV, Lender Rate 12.25%

Self employed borrower sought a business purpose cash-out 2nd TD on this owner occupied SFR in Bell Gardens, CA in LA County. Funds from our loan will be used to put back into the borrower’s drywall business. The subject property is a 2-story traditional style home sitting on a large 11,514 SF lot with a…