Fix and Rent Loan Funded

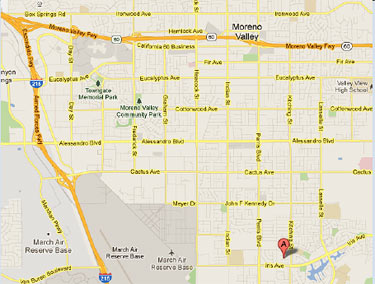

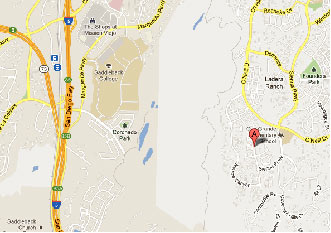

Moreno Valley, CA Download Full Summary Property / Loan Information Property Type SFR Lien Position 1st TD Loan Amount $81,900 As Is Valuation $126,000 After Repair Value $140,000 Monthly Rent $1,250/mo LTV on ARV 41.63% Loan Type Purchase Amortization 40 Year amort/due in 36 months Prepay Penalty 6 months