Successful Mortgage Vintage borrower, real estate investor, and developer sought to finish the construction short term blanket 2nd TD on three non-owner occupied 3-unit investment properties in Orange County. Proceeds from the loan will be used to complete the construction of the 3 unit properties.

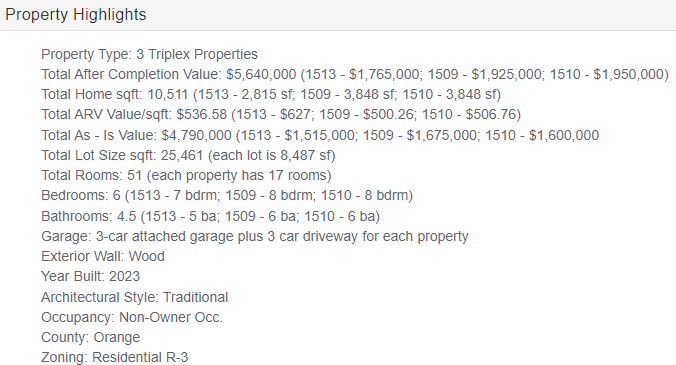

1513 W. Civic Center Dr.: is a 2,815 sf 3-unit property consisting of 17 Total Rooms. Unit 1 is 1,518 sf and has 8 Rooms: 4 bdrm, 3 bathroom (potential rental income $4,000). Unit 2 is 797 sf and has 5 rooms: 2 bdrm, 1 bathroom (potential rental income $3,000). Unit 3: is 500 sf and has 1 bdrm and 1 bathroom (potential rental income $2,000).

1509 W. Civic Center Drive: is a 3,848 sf 3 unit consisting of 17 total rooms. Unit 1 is 2,497 sf and has 8 Rooms: 5 bdrm, 4 bathroom (potential rental income $4,000). Unit 2 is 797 sf and has 5 rooms: 2 bdrm, 1 bathroom (potential rental income $3,000). Unit 3: is 554 sf and has 1 bdrm and 1 bathroom (potential rental income $2,000).

1510 W. 9th St.: is a 3,848 sf 3 unit consisting of 17 total rooms and abuts the back of the 1509 W. Civi Center Dr. property on a street-to-street lot. Unit 1 is 2,497 sf and has 8 Rooms: 5 bdrm, 4 bathroom (potential rental income $4,000). Unit 2 is 797 sf and has 5 rooms: 2 bdrm, 1 bathroom (potential rental income $3,000). Unit 3: is 554 sf and has 1 bdrm and 1 bathroom (potential rental income $2,000).

The properties are centrally located with easy access to the 22, 405, 5, and 55 fwys just south of the Discovery Science Center. The properties are located close to schools, entertainment and shopping. The exit strategy from our loan is a sale of the completed properties. 1 of the 4 properties in this development has already been completed and sold.

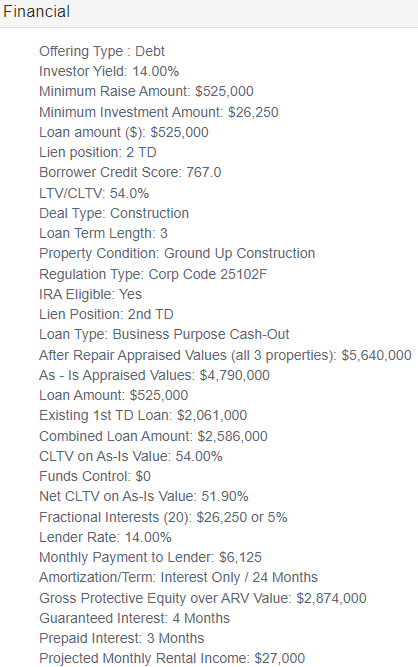

This is a 54.00% CLTV, 51.90% Net CLTV trust deed opportunity based on the recent combined As-Is Appraisal of $4,790,000. The Total Balance on the 1st TD is $2.061 Mil. including $616k+ in Funds Control. Borrower is having trouble with accessing their funds in the funds control account on the 1st TD and would like to get this loan to help them with the cash needed to finish the projects.

Our 2nd TD structure features a 3 mo. term with 4 months of Guaranteed Interest and 3 months Prepaid Interest. Minimum investment is $26,250, or 5%, yielding a 14.00% annualized return. This 2nd Trust Deed is coterminous with the 1st TD. The borrower plans to have the properties finished within the 3-month timeframe. Should the properties not be finished or sold by 12-17-23, the borrower will apply for an extension on both the 1st and our 2nd in order to have time to sell the properties.

What we like about this Trust Deed opportunity:

- Previous successful MVI Construction Team

- 14.00% annualized return on a 54.00% CLTV 2nd TD

- 45.85% CLTV on After Repair Value

- Projected $9,000/month rental income per unit, $27k/mo. total

- 4 months Guaranteed Interest and 3 months Prepaid Interest

- Orange County location

- 3 Non-owner occupied 3-unit investment properties