Very successful and experienced real estate investor of 20 + years, developer and President-Owner of privately held real estate acquisition, redevelopment and investment management company sought a 1st Trust Deed to build two SFRs on these two adjacent land parcels in Chula Vista, San Diego County, CA.

Borrower had invested $520,000 “skin in the game” to date on these subject properties on purchasing parcels, architectural, engineering and other soft costs. Exit strategy: “Build to Rent”. Borrower has a long relationship with a DSCR Lender to take out our loan after borrower receives Certificate of Occupancy when construction is completed. 6 Months Guaranteed Investor Interest on this loan. Borrower also owned two other adjoining parcels. Once these two SFRs are completed and paid off with DSCR loan, borrower will build same SFRs on other two parcels.

In addition to these subject properties, the borrower owned collective $25M value in rental income producing San Diego and San Bernardino counties’ real estate properties ranging from a 70-unit apartment building to several investment rental SFRs with a net equity of $9.8M. Monthly income generating from existing Schedule of RE averages $74K cash-flow. (Schedule of RE in investor file). Borrower December 2022 Business account ending balance shows $1.3M liquid.

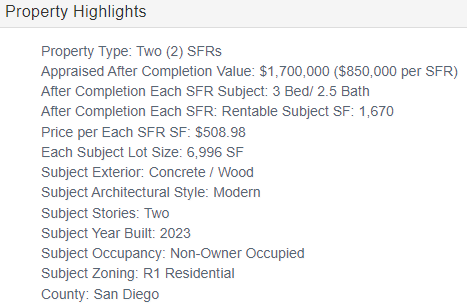

Mortgage Vintage had an independent 3rd party conduct a Construction Feasibility Report that confirmed the Funds Control from this loan will finish the two (2) SFRs, one on each parcel with a new After Completion Appraised value of $1.7M ($850K each).

The subject properties will each be a 2 story, modern style 1,670 SF living space SFR with 7 total rooms, 3 Bed, 2.5 BA sitting on 6,996 SF lots. Each SFR will feature a wood gated perimeter, large patio/deck and attached 2 car garage. Projected future market rental income for borrower is $4,800 per month per SFR.

The subject properties are surrounded by SFRs in a stable, suburban neighborhood in San Diego County, CA. Subject properties are nearby several shopping plazas, restaurants, schools, parks and the 805 Fwy.

Images are renderings of SFRs future build design.

What we like about this Trust Deed opportunity:

- 20+ years very experienced real estate investor, developer

- Two SFRs in Suburban neighborhood of San Diego County, CA

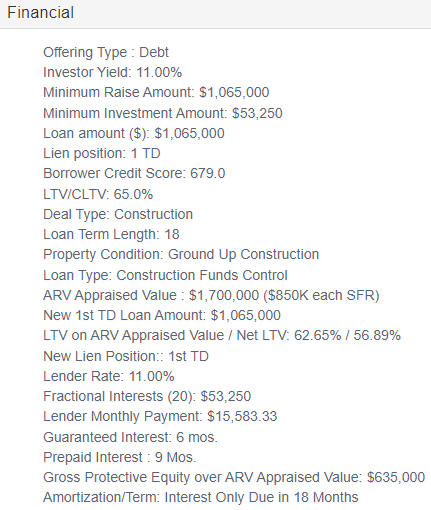

- 11.00% Investor Yield

- LTV: 62.65% / Net LTV 56.89%

- $575,000 Gross Investor Protective Equity

- 6 Months Guaranteed

- 9 Months Prepaid

- $1.3M Business Checking Account – Borrower Cash Liquidity

- Funds Control & Approved Feasibility Report