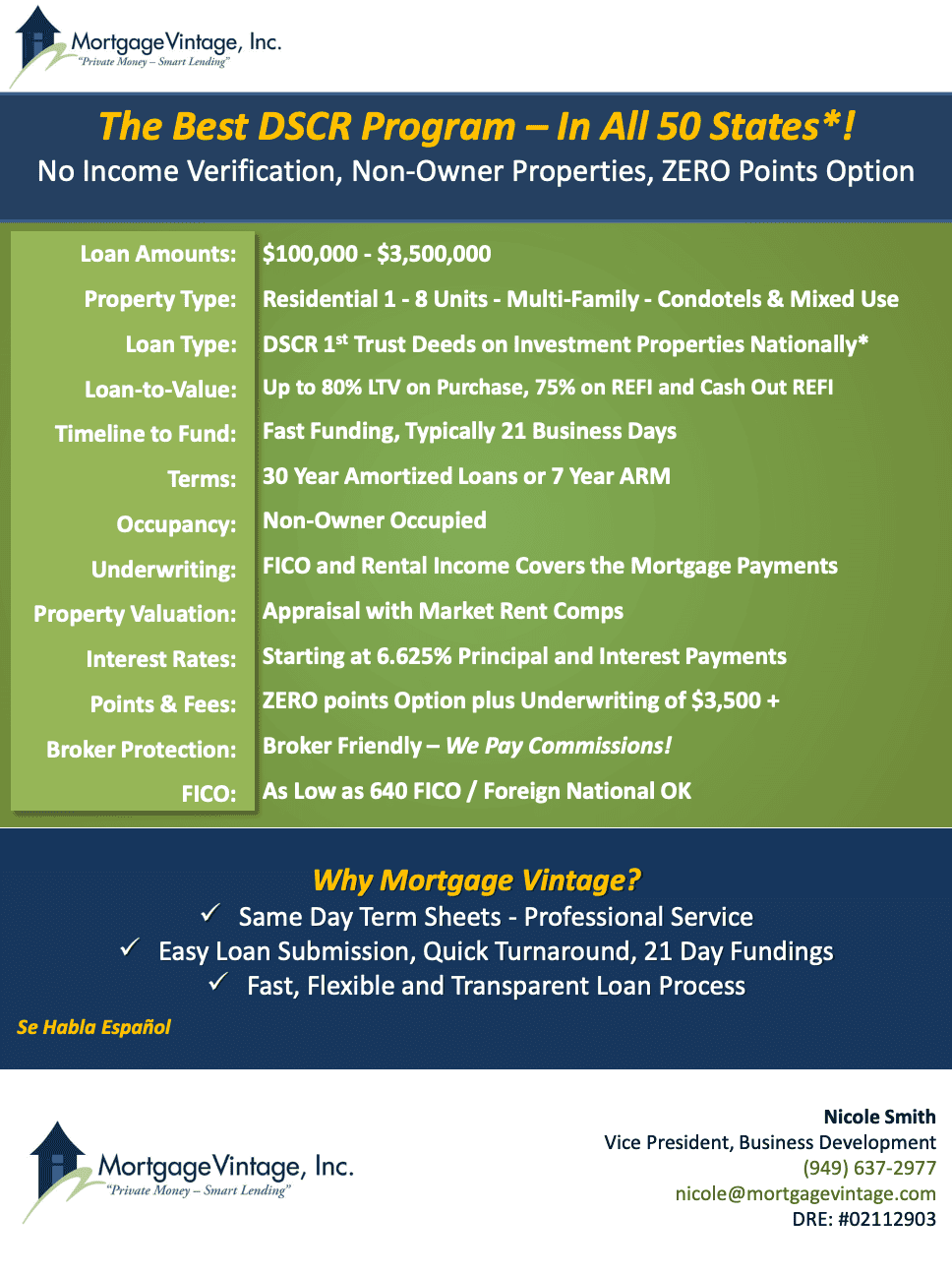

Discover the Best DSCR Loan Program

At Mortgage Vintage, we pride ourselves on offering a streamlined, transparent, and fast loan process designed for real estate investors. Whether you’re purchasing, refinancing, or cashing out, our Debt Service Coverage Ratio (DSCR) loans are tailored to meet your needs.

Why Choose Mortgage Vintage?

- Same-Day Term Sheets: Get professional service with unparalleled speed.

- Fast & Flexible Process: Enjoy quick loan submissions and approvals, with funding completed in just 21 business days.

- Transparent Terms: A simple and straightforward process from start to finish.

Program Highlights

- Loan Amounts: $100,000 to $3,500,000

- Property Types: Residential 1–8 units, multi-family, condotels, and mixed-use.

- Loan-to-Value (LTV):

- Up to 80% LTV on purchases

- 75% LTV on refinances and cash-out refinances

- Terms:

- 30-year amortized loans

- 7-year adjustable-rate mortgage (ARM) options

- Occupancy: Non-owner-occupied investment properties.

- Interest Rates: Starting at 6.625% (principal and interest payments).

Why This Program Stands Out

- Nationwide Coverage: Available in all 50 states.*

- No Income Verification: Ideal for investors who prefer asset-based lending.

- Zero Points Option: Reduce upfront costs with our flexible payment structure.

- Flexible Credit Requirements:

- FICO scores as low as 640

- Foreign nationals welcome

- Broker-Friendly: We protect brokers and pay commissions.

Property Valuation & Underwriting

- Appraisals: Includes market rent comparisons to determine accurate property value.

- Underwriting: Simplified with rental income to cover mortgage payments.

Contact Us

Sandy MacDougall – (949) 632-6145 – sandy@mortgagevintage.com

Nicole Smith – (949) 637-2977 – nicole@mortgagevintage.com

*Some restrictions may apply.

Se habla Español.