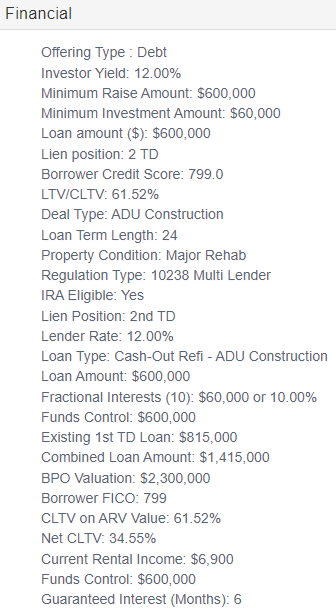

Real estate investor sought a business purpose 2nd TD cash-out on this Duplex rental investment property in Los Angeles, CA. 100% of the funds from our loan proceeds will be put into Funds Control to reconfigure the existing Duplex and add 2 new fully permitted ADU units in the back of this subject property. Exit strategy from our loan is a conventional refinance once construction is complete. The first TD is at a principal balance of $815k with a 4.25% rate.

The subject property is a traditional style Duplex in a suburban neighborhood surrounded by like properties many of which have been fully renovated. The subject property when completed will consist of two ADUs and will total 2,905 SF of rentable living space. The subject property will be divided into 4 rental units, sitting on a 6,431 SF lot. The existing duplex will be converted from two 1BR/1BA units (598 Sq Ft each) to two 2BR/2BA units (840 Sq Ft each). The new two additional ADUs once completed will each consist of 4 total rooms with 1 BR/1BA = 612.5 Sq Ft each. The subject property is very well located just East of Marina Del Rey, Play Del Rey and the Los Angeles Airport. The subject property is located near many schools, shopping, and restaurants; just West of the 405 FWY.

What we like about this Trust Deed opportunity:

- Well located Duplex; once complete 4 rentable units

- 12.00% annualized return

- 62.52% CLTV 34.55% Net CLTV

- 100% funds in Funds Control ($600k)

- 6 months Guaranteed Interest

- 799 FICO

- Current Gross Rental Income of $6,900/mo.

- Borrower bringing in over $46k cash to close the loan