Reading between the lines on Borrower loan scenarios and excuses – how it affects underwriting and loan preparation

Originating and Servicing Hard Money Loans requires active listening to a Story. There is typically a reason why the loan is not being funded conventionally. Each hard money loan’s unique scenario potentially stretches guidelines as oftentimes the loan characteristics don’t fall into a Conventional or Non-QM underwriting box. Many times, a loan’s wrinkles are legitimate and can be dealt with via the loan structure, other times, the potential Borrower may be trying to hide an issue or mask a flaw that could potentially be devastating to the transaction and ultimately the Lender.

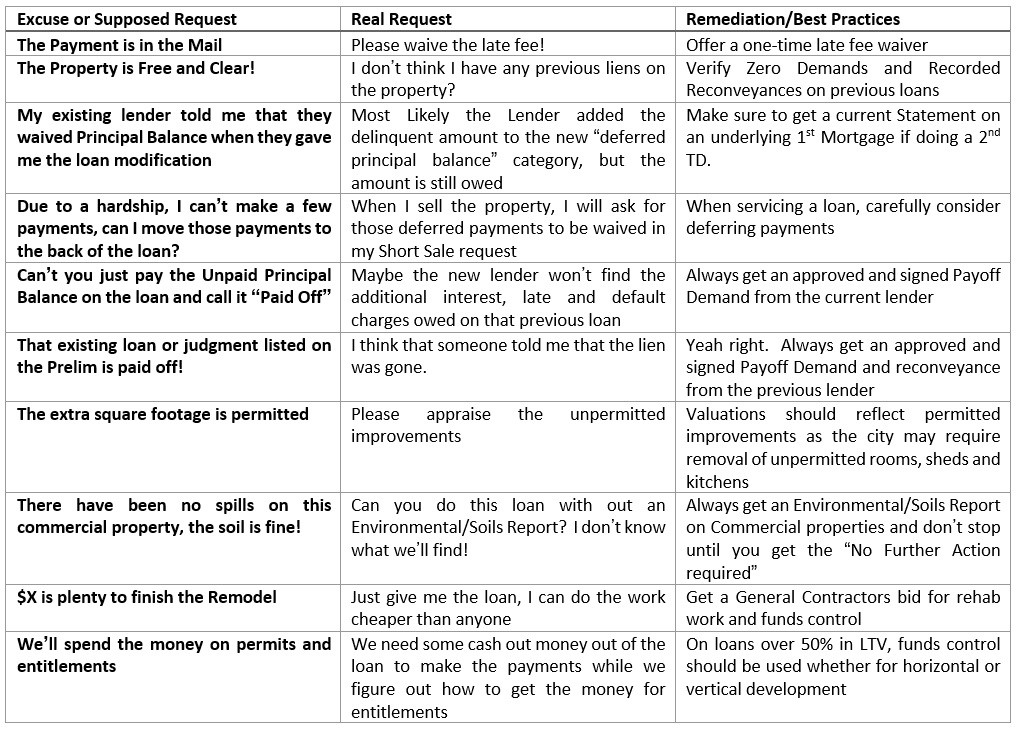

This Blog uncovers a Borrowers Excuse and/or Borrower Request during the Loan Origination or Servicing process that need careful consideration and unpacking. The table below from left to right shows the Excuse, the real request and then the best practices to mitigate the issue:

Asking the correct questions to uncover the true circumstances always helps. Sometimes the answer to the request is the Carrot and sometimes the answer is the Stick. In either case, experience and thorough underwriting can peel away the facade to find out the real underlying situation. Knowing the remediation techniques in advance will help create successful outcomes for the loan scenario and hard money lender. If you have a loan requirement or scenario, please contact us at 949-632-6145