An experienced Mortgage Vintage borrower successfully completed the construction of a three-unit multifamily property in Santa Ana, CA. Mortgage Vintage provided the original ground-up construction loan and a refinance loan to retire the original construction financing. Borrower, upon full rental stabilization plans to exit the Mortgage Vintage loan with a DSCR loan.

The Subject:

-

Address: Santa Ana, CA

-

Type: Multifamily – SFR with JADU and ADU

-

Layout: 9 BR / 6 BA across 3 rental units

-

Condition: New Construction, Fully Occupied

The Scenario:

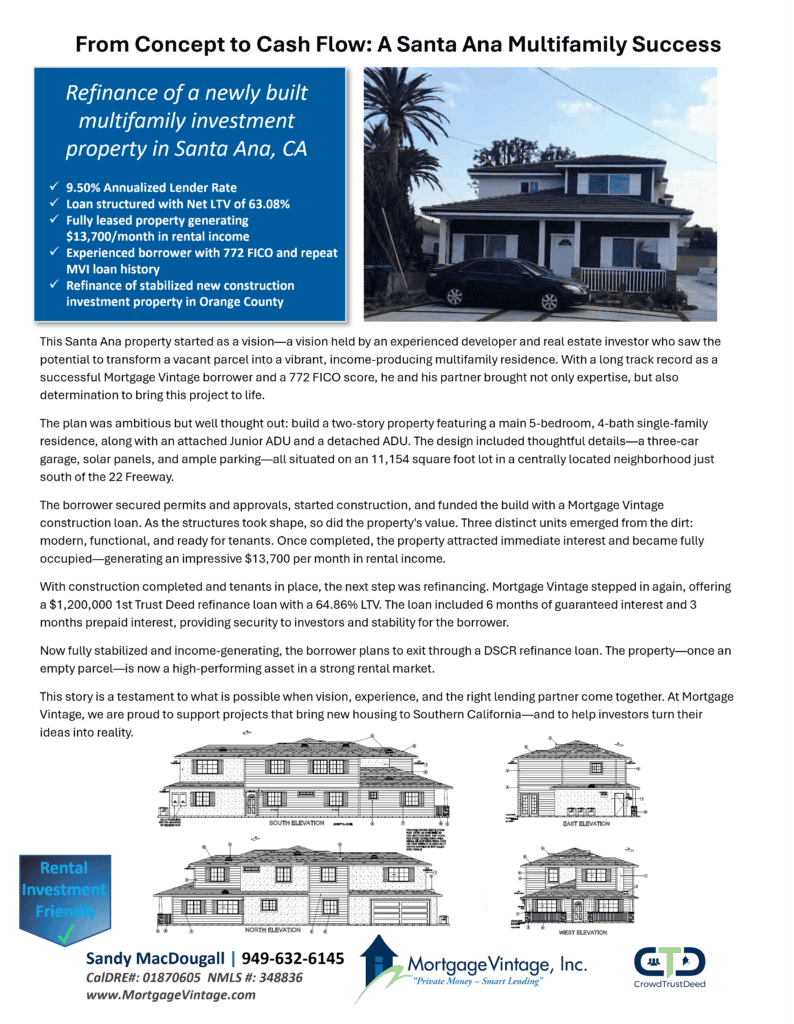

An experienced Mortgage Vintage borrower and seasoned developer with a 772 FICO score had a vision to create a new multifamily property in a prime unincorporated area of Santa Ana, CA. With the original construction loan funded by Mortgage Vintage, the borrower built a two-story property with a 5-bedroom, 4-bath single-family residence, a Junior ADU, and a detached ADU, all situated on a large 11,154 square foot lot. Upon completion, the property quickly leased up, generating $13,700 per month in rental income from three tenants. As the original construction loan matured, the borrower needed a fast and reliable refinance solution to pay off the existing debt and position the property for long-term cash flow through a DSCR loan.

The Solution:

Mortgage Vintage provided a $1,200,000 1st Trust Deed refinance loan at 64.86% LTV based on an appraised value of $1,850,000. The loan included six months of guaranteed interest and three months of prepaid interest, offering security for investors and certainty for the borrower. With strong rental income, excellent location, and a clear path to a DSCR refinance, this transaction allowed the borrower to successfully transition from construction financing to a lower-cost bridge loan while preserving significant equity and securing a high-performing investment property.

The Numbers:

-

Appraised Value: $1,850,000

-

Loan Amount: $1,200,000

-

Monthly Rental Income: $13,700 (including lock-off unit)

-

Net Protective Equity: $683,000

-

Annualized Investor Return: 9.50%