Mortgage Vintage, Inc. (MVI) is a direct hard money lender that originates and funds business purpose loans for real estate investors and business owners. Many of our loans are of the Fix & Flip variety where an investor purchases a property in relatively poor condition, and, with our funds in hand from our “80/80 Fix & Flip Loan”, the investor then fixes up the property to sell for a profit. Below are examples of successful Fix & Flip projects that we’ve partnered on with our borrowers.

The Subject:

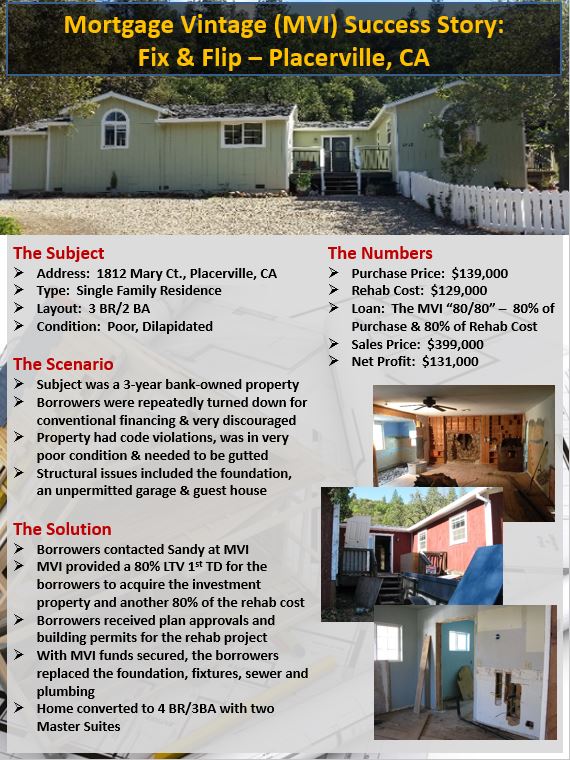

- Address: 1812 Mary Ct., Placerville, CA

- Type: Single Family Residence

- Layout: 3 BR/2 BA

- Condition: Poor, Dilapidated

The Scenario:

- Subject was a 3-year bank-owned property that nobody wanted to touch, or finance for that matter

- Our borrower was repeatedly turned down for conventional financing and very close to giving up on the deal

- The subject property had numerous code violations, was in very poor condition, and, needed to be gutted

- Structural issues included the foundation and an non-permitted garage and guest house

The Solution:

- The borrower contacted Sandy at Mortgage Vintage, Inc.

- MVI provided an 80% LTV 1st TD for the borrower to acquire the property plus an additional 80% of the rehab cost

- Borrower received plan approvals and building permits for the rehab project from the city and county

- With MVI funds secured, the borrower went to work on replacing the foundation, fixtures, sewer and plumbing

- Funding Based on Committed Terms

- The investor had the home converted to a 4BR/3BA with two Master Suites, smart move!

The Numbers:

- Purchase Price: $139,000

- Rehab Cost: $129,000

- Loan Type: MVI “80/80 Fix & Flip Loan” – 80% of Purchase Price & 80% of Rehab Cost, all on one loan

- Sales Price: $399,000

- Net Profit: $131,000