Executive Summary: Real estate owner-broker and investor sought a 2nd TD, rate-and-term refinance loan on a well-located commercial property, right on the 111 HWY near El Paseo shopping district, in Palm Desert, CA. The borrower is the owner, founder, and broker of www.firmcompanies.com, a company specializing in commercial real estate and property management throughout the Coachella Valley. The purpose of this loan is to pay off an existing and in good standing 2nd TD business-purpose loan that is maturing.

The 1st TD is held by U.S. Bank for $1,895,000. It is in good standing, has a fixed interest rate of 3.99%, and carries a monthly principal and interest payment of $10,842, maturing January 2047. The borrower plans to pay off the 2nd TD by selling subject property. Several videos of property also in investor dropbox.

Property Description: The subject property is a two-story, freestanding, multi-tenant office building located just near the prestigious El Paseo shopping district, right on Highway 111. The building sits on 1.07 acres (46,609 SF) and features a total building area of 20,740 SF, with 19,200 SF of net rentable space. The structure was originally built in 1980 and has recently undergone substantial renovations in 2025 totaling $487,707, bringing the Appraised condition to “very good.”

The site is zoned C1SP (Commercial Specific Plan), which allows for flexible uses including office, retail, restaurant, and mixed-use. The property currently generates $41,800 in monthly rental income. Tenants include 2 executive suite users operating a combined 30 offices, within a total of 36 offices, 4 kitchen/break rooms, and 13 restrooms. The building has 85 parking spaces and benefits from additional street parking. Cap Rate 7.00%

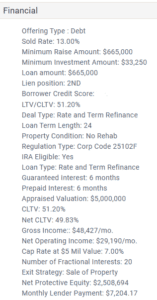

Loan Highlights:

- Great location blocks from El Paseo Shopping district, on the 111 HWY

- 13.00% Investor Yield

- Net Investor Equity: $2,508,694

- Monthly Net Operating Income: $29,190/mo.

- 6 months Guaranteed Interest

- 6 months Prepaid Interest

- 51.20% CLTV

- 49.83% Net CLTV

- Low Environmental Report – No Further Action Required

- Exit Strategy: Sale of Property

- 1st TD Current, good standing with low 3.99% Fixed Rate

$665,000 2nd TD @ 13.00%, Comm. Refi, 51.20% CLTV, 24 mo., OO, $33,250 Min., Palm Desert, CA