Successful repeat MVI borrower, 40+ years experienced real estate owner, general contractor and fix & flipper sought a Blanket business purpose cash-out 2nd TD on two SFRs investment properties in Temecula, Riverside County and Pico Rivera, Los Angeles County CA; blanket also includes a 3rd TD on borrower’s primary owner-occupied SFR in Montebello, Los Angeles, CA. All of borrower’s existing and in good standing trust deeds are on 30 years terms with low P&I rate loans ranging from conventional 2.00% – Non QM 6.50% (details on existing mortgages below).

All proceeds from this loan will be used to acquire another SFR investment property as well as marketing for borrower’s existing successful Airbnb investment properties. Exit strategy: conventional refinancing.

The subject property in Temecula, CA is a single story, ranch style, SFR + Guesthouse in excellent, newly remodeled condition; this property features 2,300 SF of living space in the main house and 320 SF living space in the guesthouse. Total of 5 Bed and 4 Bath. The property sits on 5.1 acres with a large pool, new BBQ entertainment area. This property earns avg. $10K a month on Airbnb and is used for weddings, corporate events, private parties.

The subject property in Pico Rivera, CA is a single story, ranch style, SFR in good condition; this property features 1,512 SF of living space with 3 Bed and 2 Bath. The property sits on .25 acres. This property earns $2,700 a mo./rent.

The subject property in Montebello, CA is a single story, suburban, traditional style, SFR in good condition; this property features 1,488 SF of living space with 4 Bed and 2 Bath. The property sits on .15 acres. This property is owner occupied by borrower.

All three SFR properties are well located within Los Angeles and Riverside Counties with easy access to schools, shopping and freeways.

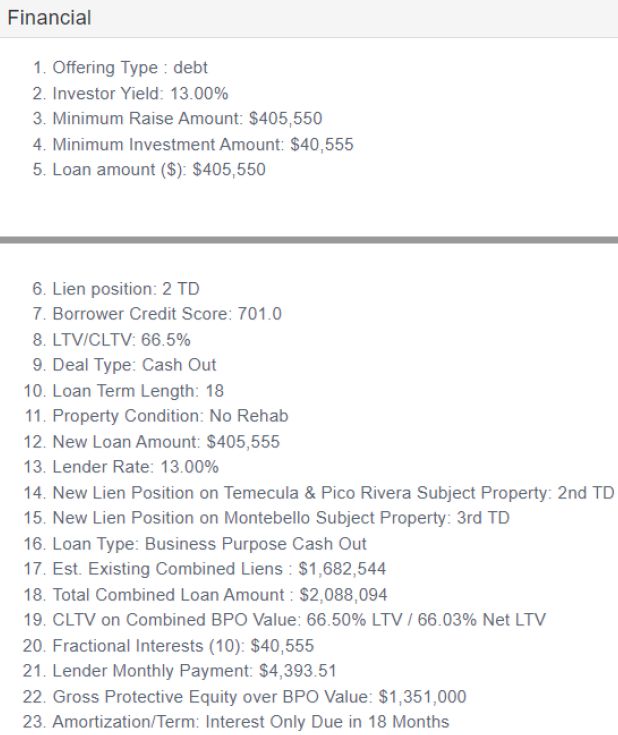

This is a 69.43% CLTV and 68.97% Net CLTV based on a combined total BPO value of $3.140M. Loan structure features 6 months Guar. Interest and 3 months Prepaid Interest. Minimum investment for this Trust Deed is $40,555, yielding a 13.00% annualized return.

What we like about this Trust Deed opportunity:

- 701 FICO, Repeat, Successful MVI Borrower

- 13.00% Investor Yield

- SFR properties in LA and Riverside counties

- 6 months Guaranteed Interest

- 3 months Prepaid Interest

- Gross Net Investor Protection: $959,770.48 on SFRs

- CLTV: 69.43%

- Net CLTV: 68.97%