Whether a Hard Money Lender (HML) uses a monolithic Customer Relationship Management (CRM) and/or Loan Origination System (LOS) or has cobbled together a variety of Systems to facilitate their loan origination, the lender should migrate towards a Digital Mortgage (DM) one piece at a time. Like how my 10 and 12-year-old Children use a fruit picker to pick the lowest Orange or Lemon on the fruit trees in Palm Desert, Lenders should start the evolutionary DM process by choosing the most appropriate, low hanging and impactful Digital Mortgage element.

As Hard Money Lenders move along the automation maturity curve, many opportunities for process improvement, cost savings and data-driven insight await them. As Joe Tyrell, EVP at Ellie Mae, mentioned when he and I spoke together on the Digital Mortgage Topic at a recent California Mortgage Association (CMA) conference. “The goal of the digital mortgage is to make home financing simpler and easier for consumers and to make it compliant and profitable for lenders.”

Clearly, the future is now in terms of deploying the next wave of digital capabilities to transform Hard Money business models. The borrower experience, efficiency, cycle time, cost reduction, quality and compliance benefits outweigh the consequences of complacency. The lenders and servicers who intend to compete and sustain market viability must embrace the digital opportunity. A Digital Mortgage cannot be achieved through a flip of a switch in a single giant implementation, but rather should be implemented as point solutions to automate key parts of processes without significantly overhauling their underlying systems.

With this promising customer experience enhancing and profit inducing Goal in mind, Hard Money Lenders need to evaluate their Mortgage Workflow and decide which piece of the DM spectrum they want to start with. When assembling a jigsaw puzzle like the one above, a common way to start is to pick the corner pieces with the straight edges to start the puzzle. Similarly, when a lender decides to implement a DM element, the lender should choose the piece in the DM Spectrum that is easiest to automate and makes the most impact on the customer experience. Getting the corner pieces in place in a puzzle and putting a few stakes in the ground along the mortgage spectrum will facilitate a move to finishing a puzzle and a more comprehensive, effective and transformative Digital Mortgage.

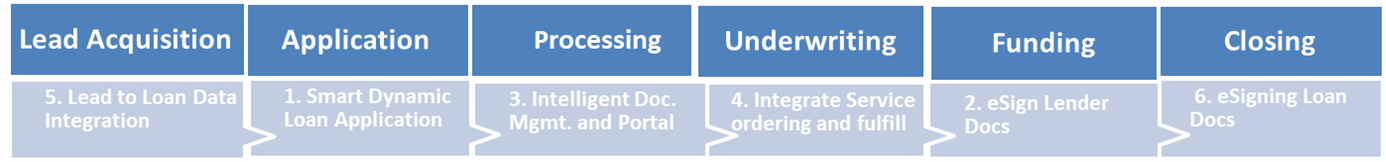

As an example, one Hard Money Lender selected to automate the loan process continuum in the following numerical order:

In this illustration above, the lender selected the top priority items in each process category and elected to start their DM implementation with the Smart Application which allows for intelligent and intuitive questions vs. a standard 1003 fillable PDF or online form. The 2nd area this lender approached is eSigning Lender Docs. The 3rd selection is the Borrower Portal that facilitates intelligent document uploading. The Lender plans to roll-out items 4-6 after these initial 3 stages and subsequently move to additional elements in the same workflow category.

To truly reap the rewards of a Digital Mortgage, Hard Money Lenders will do well to seek out a plan that captures the opportunity not as a single process, but rather as part of a unified continuum of complete workflow management, from application to ordering services to document delivery, execution and fulfillment. If you have a hard money loan requirement, and want a great experience, please contact us at 949-632-6145 or visit our website at www.mortgagevintage.com or www.crowdtrustdeed.com today.