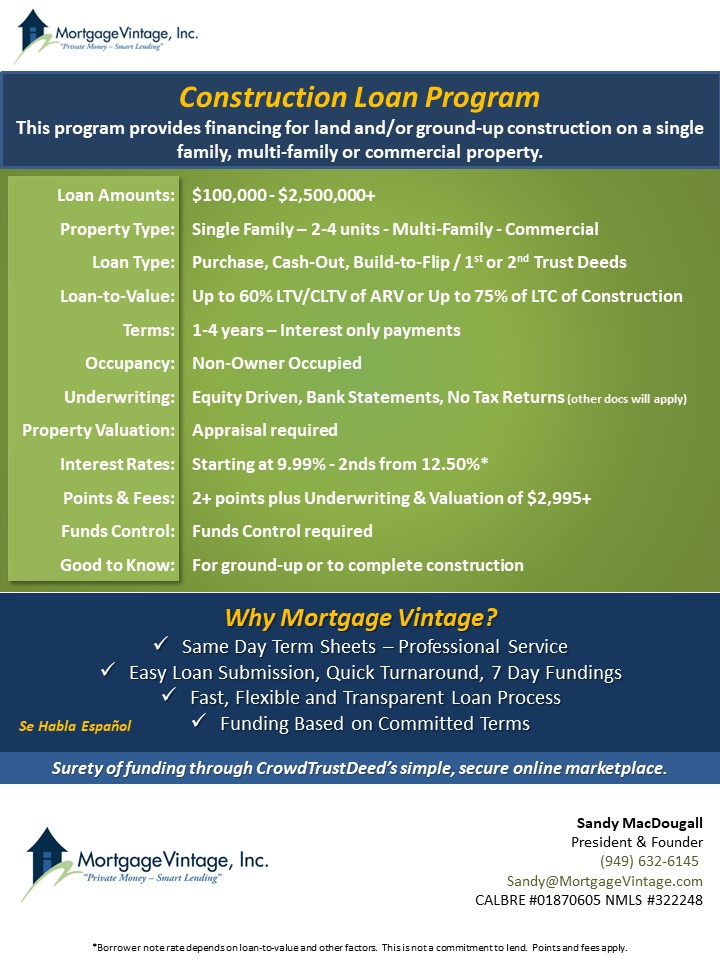

Construction Loan Program:

A construction hard money loan can be used to finance the acquisition and construction of real estate properties. These hard money loans are great alternatives to conventional or government loan programs if your project has specific deadlines. Loan Terms can range from 1-4 years and the 1st or 2nd Trust Deed provides funds for ground-up or to finish construction on single-family, multi-family and commercial properties.

Lending Criteria & Guidelines:

- Loan Amounts: $100,000 – $2,500,000+

- Property Type: Single Family – 2-4 Units – Multi-Family – Commercial

- Loan Type: Purchase, Cash-Out, Build-to-Flip – 1st and 2nd Trust Deeds OK!

- Loan-to-Value: Up to 60% LTV/CLTV of ARV (After Repair Value) or up to 75% LTC (Loan-to-Cost), whichever is less

- Terms: 1 – 4 years on Non-Owner Occupied – Interest Only Payments

- Occupancy: Non-Owner Occupied

- Underwriting: Equity Driven, Bank Statements, No Tax Returns (other docs apply)

- Property Valuation: Appraisal Required

- Interest Rates: 1sts from 9.99% – 2nds from 12.50%*

- Points & Fees: 2+ Points plus Underwriting & Valuation of $2,995+

- Funds Control: Required

- Good to Know: Short-Term Bridge, for Ground-Up or to complete construction. Great loan program if current conventional is maturing

- “Yes, We Can!”: Low FICO – BK – NOD – Foreign National – Self Employed

Why Mortgage Vintage, Inc.?

Mortgage Vintage, Inc. is a direct hard money lender that originates and funds business purpose loans for real estate investors and business owners. All Mortgage Vintage loans must be secured by California real estate. We provide:

- Same Day Term Sheets – Professional Service

- Easy Loan Submission, Quick Turnaround, 7 Day Fundings

- Fast, Flexible and Transparent Loan Process

- Over 30 years Financial Industry Experience

- Funding Based on Committed Terms

- Surety of funding through CrowdTrustDeed’s simple and secure online marketplace

- Se Habla Español

Contact:

Sandy MacDougall – (949) 632-6145 – sandy@mortgagevintage.com