Investment Opportunity: 1st Trust Deed Refinance Loan

A highly qualified borrower, a proven track record as a repeat Mortgage Vintage investor, and extensive real estate experience sought a 1st Trust Deed refinance loan for a newly built, non-owner-occupied multifamily property in Santa Ana, Orange County, CA. The loan proceeds will refinance existing Mortgage Vintage maturing construction loans.

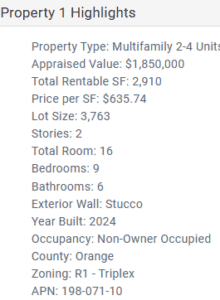

Property Overview:

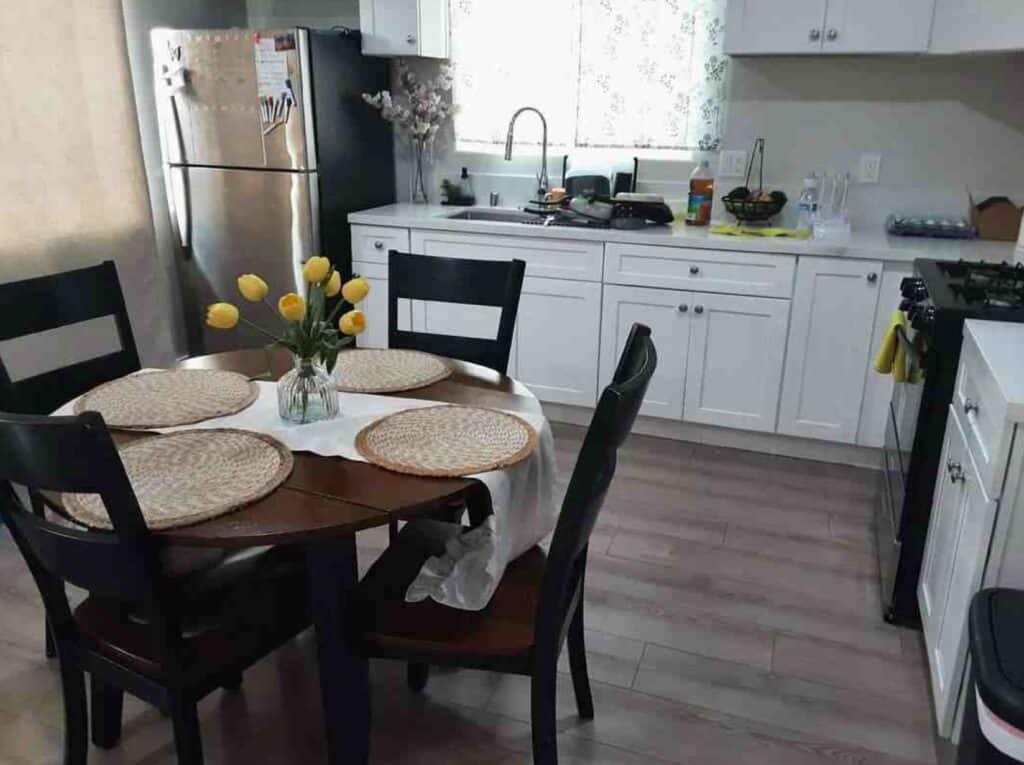

The subject property is a newly constructed, fully occupied, two-story multifamily residence in Santa Ana. It consists of two buildings (SFR, attached JADU, ADU) with a net rentable area of 3,763 SF, situated on an 11,154 SF lot. Key features include:

- 16 rooms, including 9 bedrooms and 6 bathrooms

- Three-car garage, solar panels

- Fully occupied with three tenants generating an official $11,200 in monthly rental income from the 3 rental units but, unofficially, the property generates $13,700/mo. when incorporating the lock off unit.

- Prime location near parks, restaurants, schools, shopping centers, and easy access to the 5 and 55 freeways

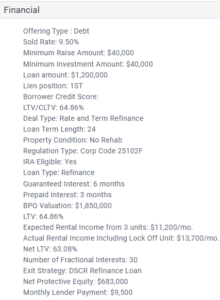

Loan & Investment Details

- Loan-to-Value (LTV): 64.86%

- Net LTV: 63.08%

- Appraised Value: $1,850,000

- Investor Yield: 9.50% annualized return

- Guaranteed Interest: 6 months

- Prepaid Interest: 3 months

- Minimum Investment: $40,000

- Exit Strategy: Borrower plans to refinance into a new DSCR loan