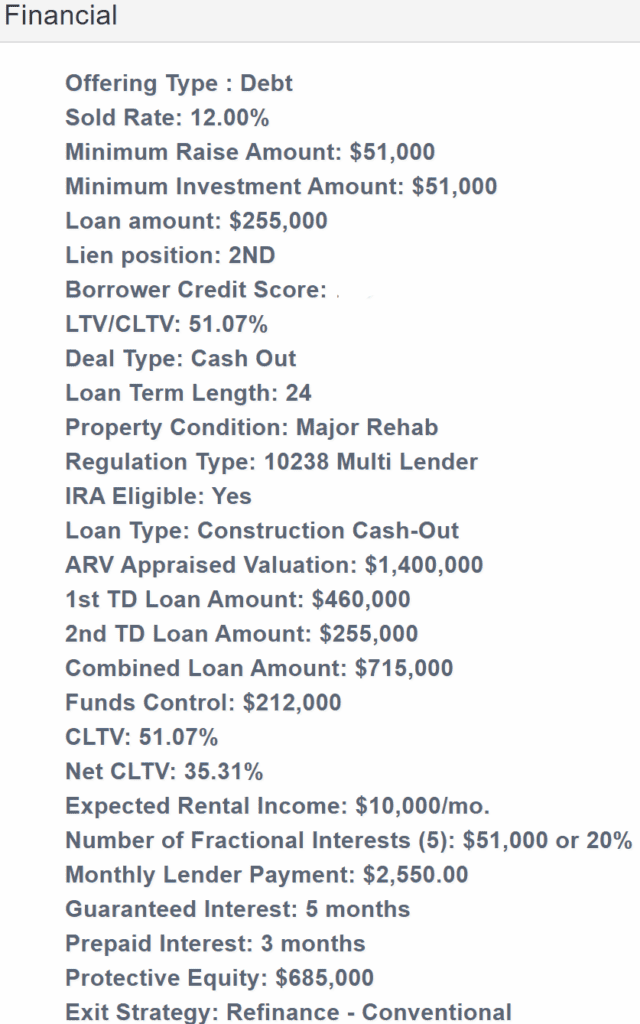

1. Loan Purpose: Borrower and real estate investor sought a $255,000 2nd Trust Deed business purpose cash out loan on this non-owner-occupied fully tenant-occupied tri-plex in San Diego. The loan proceeds will be used to complete a 2-unit ADU. The complete project is $449,000 to build. The Borrower has already paid $237,000 in costs towards the construction. The remaining $212,000 will be held in Funds Control to complete the project.

The 1st mortgage is current with a principal balance of $459,541.71, a fixed interest rate of 4.375%, maturing on May 1, 2052, and a P&I of $2,814.59/mo. The first lender impounds for taxes and insurance. Exit Strategy: Conventional refinance.

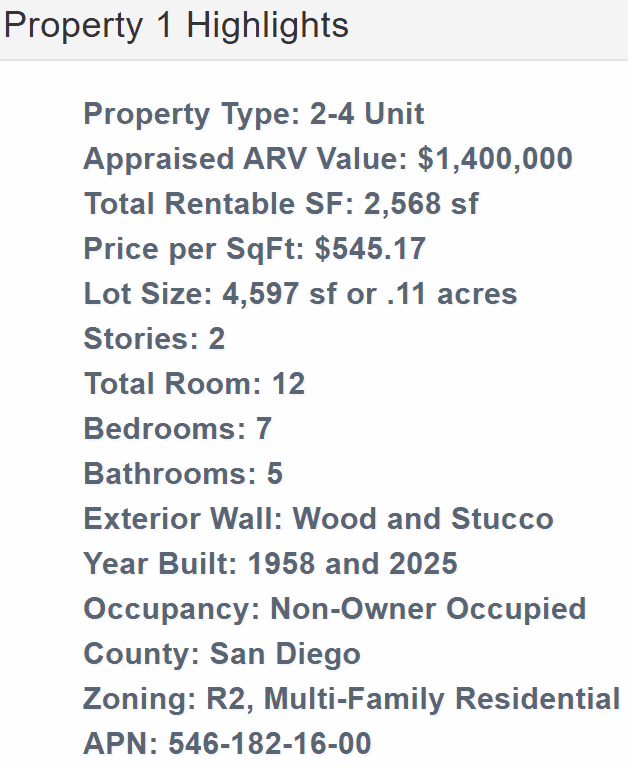

2. Property Description: The property is currently a triplex and includes an existing freestanding 3-unit multi-family building. The loan proceeds will be used to build a 2-unit ADU. Once complete, the subject will be 2,568 sf. The proposed 2-unit ADU will be 2 stories and will consist of 1,200 sf that will offer 2 two-bedroom/one-bathroom units which will be 600 sf each. The existing 3-unit building is 1,368 sf with 3 one-bedroom/one-bathroom units. Each unit is 456 sf. Once completed the 2 bedroom/1 bathroom units can command a rent of $2,350. The 1 bedroom/1 bathroom units are currently occupied and renting for $2,000/mo. Once fully occupied, the property will generate $10,700 in rental income a month. The property is located in the residential neighborhood known as Mountain View, east of the 15 Fwy, between the 94 and 5 Fwys. In addition, the property is located within a mile of shopping and retail.

What We Like:

- Desirable neighborhood in San Diego

- 12.00% Investor Yield

- 51.07% CLTV and 35.31% Net CLTV

- 5 Months Guaranteed Interest

- 3 Months Prepaid Interest

- $685,000 Protective Equity

$255,000 1st TD @ 12.00%, NOO, Multi-Family, 51.07% CLTV, 24 mo., $51,000 Min., San Diego, CA