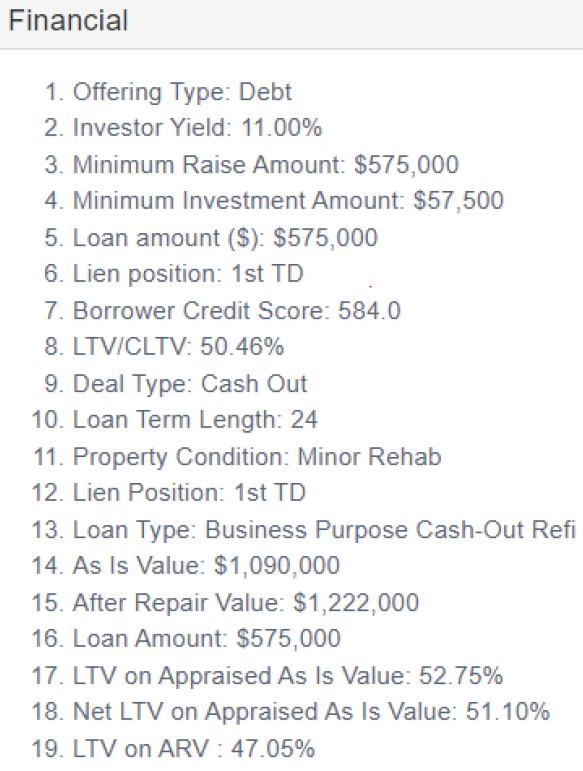

Business owner and real estate investor sought a new business purpose cash-out 1st TD on this non-owner occupied commercial property in Los Angeles. Co-Borrower has a high FICO and is the Borrower’s wife and is a successful Dr. with her own practice in Santa Monica. Los Angeles and has her own Funds from our loan will be used to 1) payoff the existing first mortgage and 2) to complete the improvements to the property. The Borrower is a General Contractor has already invested $112,372 into the improvements. The remaining work is estimated to cost $48,300 and will be held in a funds control account and will primarily pay for the labor and the Borrower has already purchased the majority of the materials.

The subject property is 4,200 SF mixed used Class D commercial property, originally built in 1956, sitting on a 5,400 SF lot. The subject property includes a proposed mixed-use commercial/residential property that offers an existing structure that is under renovation. Once completed, the ground floor commercial space will consist of 3 units that will each offer 700 sf and their own restroom (potential market rent for each unit is $1,050). The second-floor residential space will consist of one, 2-bedroom/2-bathroom unit that will offer 1,350 square feet (potential market rent $2,850) and one, 1-bedroom/1-bathroom unit that will offer 750 square feet (potential market rent $1,540). The property is located in the central portion of Los Angeles just west of the 110 Harbor Fwy and south of the 10 Fwy, close to shopping and restaurants. Exit strategy from our loan is a conventional refinance. The Substandard Condition and associated Lien will be repaired with the $50k Funds Control Funds.