Now may be the time to Cash Out and Capitalize on the steamy housing market. Home prices continue to reach record highs in the United States. The National Association of Realtors (NAR) released data showing that average home prices in June 2021 reached $363,300 — a 23.4% increase over the average of $294,400 in June 2020, as well as the 112th consecutive month of year-over-year gains. In the West, including California, the median cost of a home averaged $507,000 and prices rose 17.6% during this 12-mo. period.

Yet, today’s housing market is glaringly different than the runup to the Great Recession. That housing market was built on the backs of easy credit, pick-a-payment plan, subprime lending, zero-down loans, easy qualifying, and fraudulent lending. Prior to the bubble deflating, there were obvious signs of a pending housing collapse: way too much supply of available homes to purchase and diminished year over year demand.

Today, it is completely different. Conventional Borrowers must qualify for loans and prove that they can afford the monthly payment. The process is intentionally cumbersome to prevent a repeat of 2007 to 2011. The current housing boom is quite simply due to supply and demand. Everyone is acutely aware of the current plight of the housing market: there just are not enough available homes to purchase. Supply is low.

NAR chief economist Lawrence Yun sees no signs of a serious fallout: “At a broad level, home prices are in no danger of a decline due to tight inventory conditions. Amid a rocky labor market recovery, the American housing market is short by up to one million workers. Meanwhile, construction of new long-term housing has steadily slowed over the past several decades such that demand exceeds supply by over five million homes.”

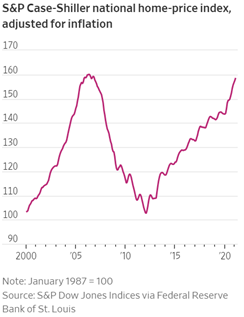

Robust homebuying demand, driven by ultralow mortgage interest rates, and this shortage of homes for sale have pushed prices rapidly higher in recent months. The dramatic price increase, as depicted in the below graph from Case-Schiller also reflects an equally large increase in home equity. Total home equity cashed out in the first quarter of this year is estimated at $49.6 billion, up nearly 80% from a year earlier, according to data from Freddie Mac.

A Cash Out and Capitalize Business Purpose Loan using Home Equity strategy also can provide homeowners access to quick Cash for real estate or other investments. Recently funded Business Purpose loans have included funds for: A Fix and Flip purchase, a business partnership buyout, a VRBO rental property, an Accessory Dwelling Unit (ADU) addition, and even a loan for a friend to buy a Shrimp Boat in Louisiana. Whether the investment is to fund your dream or a friendsnfamily’s aspiration, a Cash out and Capitalize Business Purpose loan can help a dream become a reality today. Mortgage Vintage, Inc. (MVI) offers Business Purpose Loans in 1st and 2nd Positions. Please check out this exciting loan program today at MVI Business Purpose Loans.