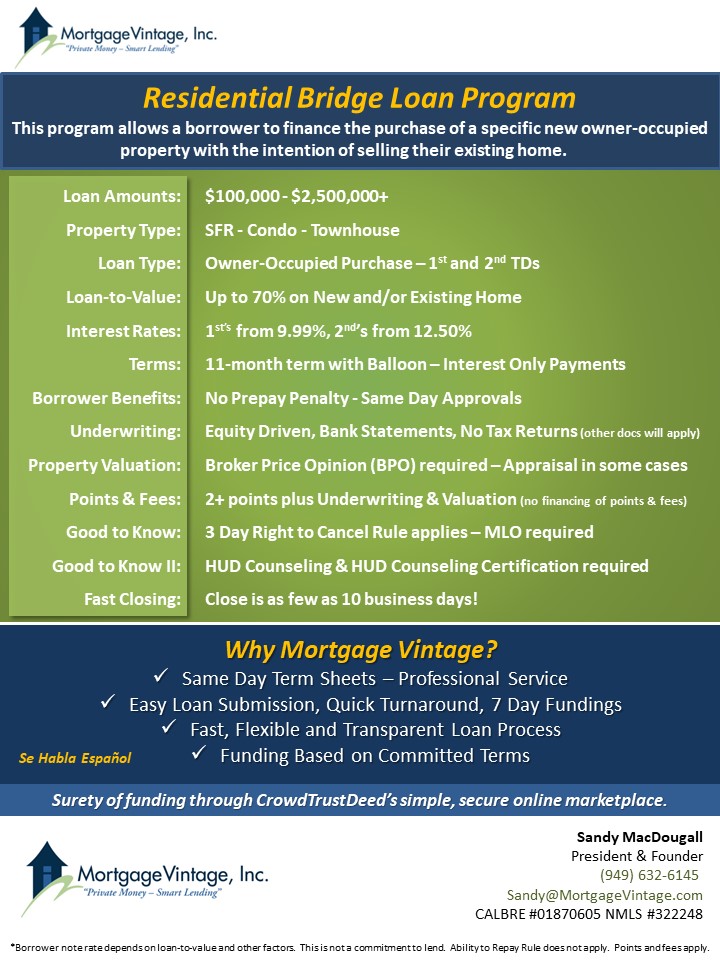

Residential Bridge Loan:

Residential bridge loans allow homeowners to use the equity in their current home to facilitate the purchase of their new owner-occupied home before they have sold their existing home. This Bridge Loan allows a buyer to make an attractive and solid non-contingent offer on their new home purchase. We offer 11 month or less residential bridge loans to borrowers for peace of mind while they wait to sell their existing home.

Lending Criteria & Guidelines:

- Loan Amounts: $100,000 – $2,500,000+

- Property Type: Single Family – Condo – Townhouse

- Loan Type: Owner Occupied Purchase – 1st and 2nd Trust Deeds OK!

- Loan-to-Value: Up to 70% on New or Existing Property

- Terms: 11-months with Balloon – Interest Only Payments

- Underwriting: Equity Driven, Bank Statements, No Tax Returns (other docs apply)

- Property Valuation: BPO (Broker Price Opinion) required – Appraisal in some cases

- Interest Rates: 1sts from 9.99%, 2nds from 12.50%

- Points & Fees: 2+ Points plus Underwriting & Valuation of $2,995+

- Good to Know: 3-Day Right to Cancel Rule applies. MLO required. No Financing of Points and Fees. HUD Counseling and HUD Counseling Certification Required. No Prepayment Penalties. Same Day Approvals.

- “Yes, We Can!”: Low FICO – BK – NOD – Foreign National – Self Employed

Why Mortgage Vintage, Inc.?

Mortgage Vintage, Inc. is a direct hard money lender that originates and funds business purpose loans for real estate investors and business owners. All Mortgage Vintage loans must be secured by California real estate.

- Same Day Term Sheets – Professional Service

- Easy Loan Submission, Quick Turnaround, 7 Day Fundings

- Fast, Flexible and Transparent Loan Process

- Over 30 years Financial Industry Experience

- Funding Based on Committed Terms

- Surety of funding through CrowdTrustDeed’s simple and secure online marketplace

- Se Habla Español

Contact:

Sandy MacDougall – (949) 632-6145 – sandy@mortgagevintage.com