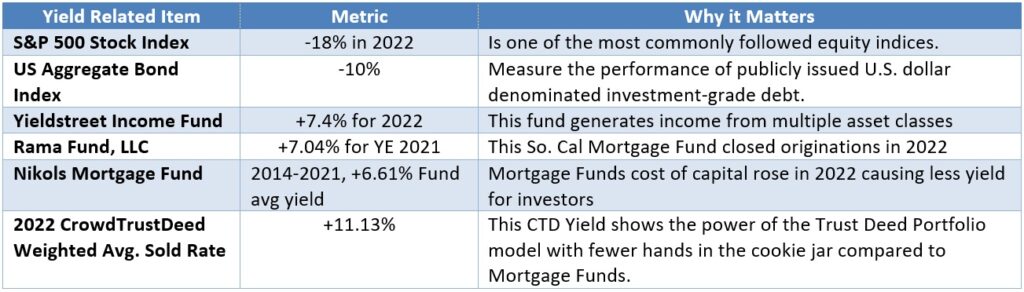

Inflation, interest rates, and commodity prices came roaring back in 2022 and caused market turmoil in many asset classes. Inflation peaked mid-year in the US at circa 9%, housing and food prices rose strongly, and many Wall St. instruments dropped precipitously. Despite volatility in these capital markets, Trust Deed Portfolios continued to generate consistent results, with an annual weighted average yield of 11.13%. Over the past eight years, Mortgage Vintage and CrowdTrustDeed have been able to generate strong returns by providing fast and reliable crowdfunded capital to business purpose borrowers.

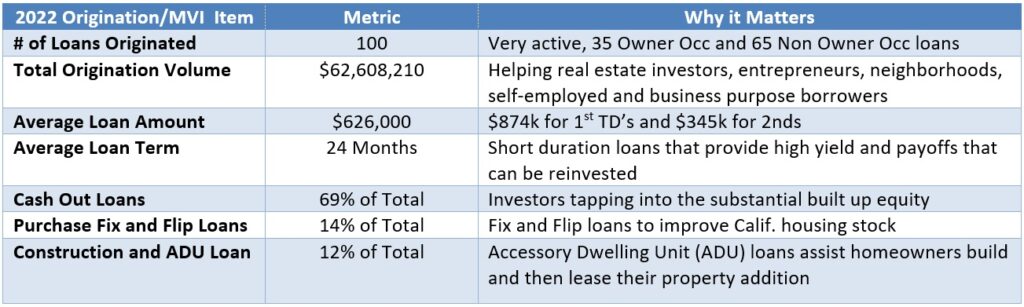

The following tables show important and meaningful metrics related to Yields, Origination and Servicing of the Hard Money Loans and Trust Deed Investments created by Mortgage Vintage and CrowdTrustDeed:

Comment: A Trust Deed Portfolio yielded 29.13% more than an S&P Index Fund and 4.11% more than the avg. Mortgage Fund Listed above

Comment: Borrowers and Brokers benefit from loan flexibility, fast closings and online transparency

Comment: A Lenders secured investments receive non-correlated cash flow on loans they select