What does it mean to be short to close?

Property sellers, brokers and borrowers cringe when they hear the phrase, “Short to Close”. This Escrow alarm sent out to all stakeholders in the transaction means that the loan amount is not sufficient to cover all the costs necessary to close the loan transaction. Unfortunately, the Short to Close alert arrives late in the transaction cycle as the Payoff’s and additional costs arrive.

The question that this Blog will address is what happens next? Today’s Blog discusses this Short to Close phenomenon and how it happens and what to do when there is not enough money to fund the obligations of the real estate purchase or refinance transaction.

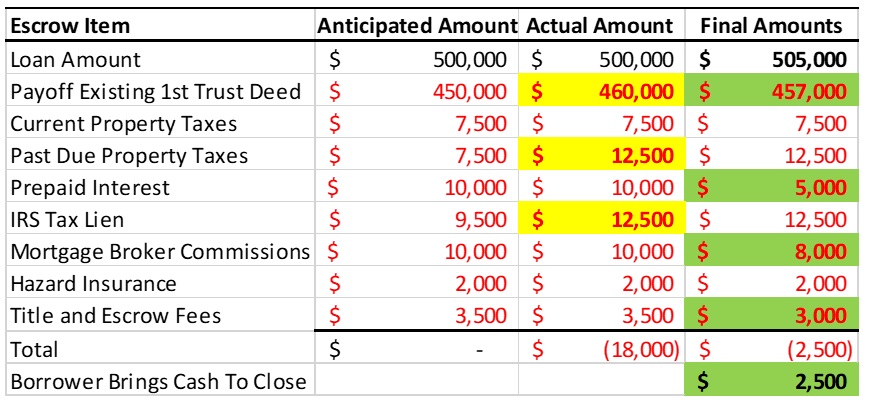

The example below shows a sample Loan Estimate that results in a Short to Close situation. From left to right the columns show the Debit and Credit items in an escrow, the anticipated payoff amounts, followed by the Actual Amounts owed for the payoffs and the final column on the right shows how the short to close situation was resolved.

When the Red items that need to be paid in the Table below are subtracted from the amount of the Loan, there is not enough money to close the transaction. In this example and as seen in the Actual Amount column and highlighted in Yellow, the Payoff on the existing 1st Trust Deed came in higher than anticipated as did the delinquent property taxes and the IRS Tax Lien resulting in a Short to Close Amount of $18,000

These real estate finance closing situations require many stakeholders to tighten their belt if the transaction is to successfully close. The Final Amounts column and the items highlighted in Green show how this Short to Close situation was resolved. The initial lender reduced their Payoff Demand and the Prepaid Interest was reduced. Additionally, the Mortgage Broker and Title and Escrow reduced their fees. Ultimately, the borrower was still short to close by $2,500 so the borrower brought in that $2.5k amount to close.

In some instances, the Short to Close situation cannot be resolved and the transaction dissolves. Last week we finally received a long-awaited PACE or HERO Loan Payoff where the borrower thought the amount of the PACE Loan that we had planned to pay off was approximately $20,000. Well, the Payoff Demand for that PACE Loan came in at $60k leaving the borrower $40k short to close. That shortfall was too much to overcome and we cancelled the transaction.

During these challenging times Hard Money Loans are becoming more and more important to help real estate investors and business owners manage cash flow and short-term liquidity issues. Borrowers needing a hard money loan should choose a proven Lender that can navigate last minute dynamics of a loan closing including the dreaded “Short to Close”.