Thank you to all the Mortgage Vintage and CrowdTrustDeed related parties who contacted California Assembly members asking for a “NO” vote on AB 2501 earlier this month. With your help, AB 2501, the disastrous California Foreclosure Prevention Bill, appears dead for 2020. This outcome to defeat AB 2501 was the result of an enormous coalition effort in opposition, of which you and the California Mortgage Association and many other real estate investors, hardworking Americans, and Patriots were important parts.

It is critical to note that the AB 2501 issue is NOT dead forever; there are still rule waiver possibilities, and the author of AB 2501 could amend the bill in the Senate for consideration later in the next Legislative Session. But, this initial defeat of Sacramento’s proposed blanket foreclosure moratorium and required forbearances was a very important milestone, for which we are very grateful. You should feel proud that our collective voice was heard in Sacramento loud and clear.

I wanted to briefly explain why it is important to maintain California’s Non-Judicial Foreclosure process. California law provides for two types of foreclosure: judicial (court involvement) and nonjudicial (no court involvement; this is the most utilized method). Nonjudicial foreclosures are utilized in situations where the deed of trust securing the mortgage loan includes a power-of-sale clause. This clause grants the trustee power to sell the property to satisfy the outstanding loan if the lender requests him to do so, in the event the debtor fails to submit timely payments. Incorporating a power of sale clause in a deed of trust or mortgage necessitates the borrower to pre-authorize the sale of their property to pay off the loan balance if they default.

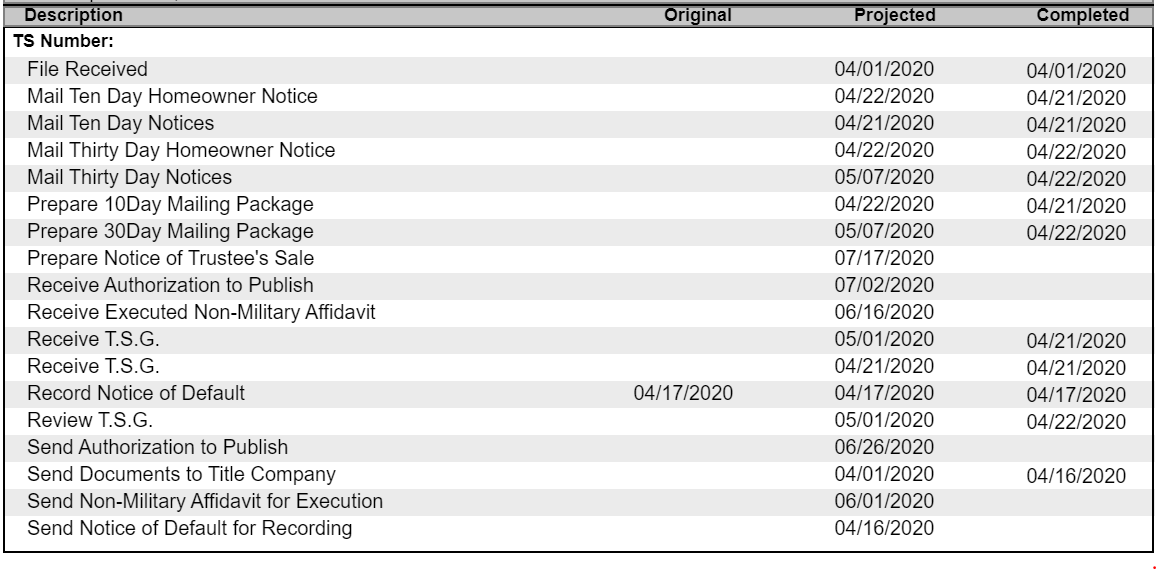

Lending organizations who utilize the nonjudicial foreclosure option against debtors, who do not meet their loan repayment obligations, forfeit their right to collect a deficiency judgment against the defaulting party. A deficiency judgement is where lenders obtain monetary awards from the court covering the difference between the total amount the borrower owed (including penalties, fees, and costs) and the amount that the property was sold for at the auction. Most lenders choose the nonjudicial foreclosure process even though they give up the possibility of deficiency judgement, because the overall nonjudicial route is more expedient and can be completed at a lower cost. See Table 1 Below: Table 1:

The key takeaway from this Table is not the minutia of the process, it is the fact that there is a timeline and process. The fact that the process can proceed via statute vs. the Courts makes California a very favorable environment in which to lend.

If the loan is for business purposes, the following steps apply to a Default:

- The lender records a Notice of Default in the local jurisdiction of the property. The lending entity then sends the borrower a copy of the notice via certified mail within 10 business days of formally recording it. The borrower is then afforded 90 days to cure the default.

- If the borrower fails to cure the outstanding loan balance within 90 days, a Notice of Sale is recorded announcing that the trustee will auction the property in 21 days. The Notice of Sale must be sent via certified mail, be published weekly in a local periodical, be posted on the affiliated property in addition to a public place such as the Town Hall, and must include details such as the date, time, and location of the foreclosure auction.

- At least 21 days following the recording of the Notice of Sale, the property can be auctioned publicly. The highest bidder is required to pay the full amount immediately with cash or certified check and receives a trustee’s deed.

- Borrowers have up to five days preceding the auction to cure the default and halt the entire process. If the maturity date has not passed and the borrower cures the default, this is referred to as the loan being “reinstated.” If the default is due to the maturity date passing or is the result of some other non-monetary default, the borrower’s only option is to repay the loan (and all outstanding amounts) in full in order to stop the sale.Bottom of Form

- A new owner after a foreclosure sale cannot simply enter the property, change the locks, and move in if the borrower was living at the property. The new owner will need to evict the resident through an unlawful detainer process. Additionally, if the property has commercial or residential tenants, unless the leases were subordinated to the deed of trust, those tenants will retain rights after the foreclosure sale.

These laws or statutes dictate the timeline and procedures for a Foreclosure. The filings, timelines, notices, remedies, and process for the actual Trustee Sale are all defined. I went to the Pomona Courthouse courtyard earlier this week for a Trustee Sale and while the sale did not occur on our property as the Borrower filed an emergency bankruptcy at the last minute, it was great to see the sale process at work with the Cryer and the bidders, masks and all! Bidders, managing two phones at a time, still carry wads of Cashier’s Checks in their bulging pockets ready to buy!

A Default process through a Non-Judicial approach remains key for the Real Estate Finance industry. Trust Deed Investors today know that there is a timeline, that there is an exit in case of Default by the borrower, that the same rules apply to everyone and that the system cannot be gamed forever.

Through our representative Democracy, the Sacramento Assembly heard your voice on AB 2501. Your emails, phone calls and conversations with your Representatives helped our California Government understand your desire to have Government regulate but not dominate. Your voice wrestled free a market driven approach to Defaults and squelched a government proposed stranglehold on property rights, Contracts, fairness, and the rule of law.

I currently serve on the Board of Directors of the California Mortgage Association (www.californiamortgageassociation.com, CMA). CMA offers Education, Advocacy and Resources for the Private Money Lending community. CMA realizes that Many legislatures don’t understand what we do or who we are, they have no clue, and through CMA’s Lobbying efforts and your communications, the Congressman are educated and understand how devastating a bill like AB 2501 would be. Thank you for your support and for contributing to our peaceful but loud voice.