One of the most important underwriting elements for Hard Money Lenders and Trust Deed Investors is the Loan to Value Ratio (LTV). The Loan to Value Ratio is defined as the Loan Amount divided by the Value of the property. The question is: Which Value? LTV provides guidance for lenders and investors on how much to loan on a property and how much “equity cushion” will be available should a problem arise with the borrower, property or payments.

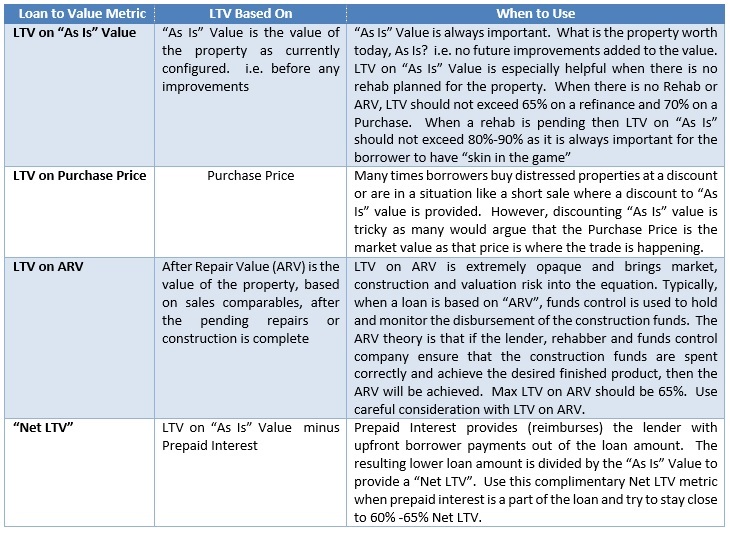

The confusion for Hard Money Lenders and Investors is that there are at least 4 definitions of “Loan to Value” on loan program advertisements and Trust Deed Offerings. How does an Investor/Lender know which definition to use and when? Should a Lender use a combination of these LTV metrics? If so, which ones? The Table below explains the 4 Loan to Value (LTV) definitions and provides guidance on which LTV ratio to use and when:

Whether borrowing or lending a Trust Deed, be sure and ask which “LTV” is being used. Do you have thoughts on LTV’s? We would like to know.